4.01%

AER/Tax-free (Fixed)

Find out moreRecommended results...

If you’d like to make tax-free savings, a cash ISA could be the right choice for you, it could even help you get more out of your money.

Apply for a Hodge ISA quickly and easily, choose from a one, two, three or five year term and apply online. Remember, the tax treatment of your savings will depend on your personal circumstances and may change in the future.

4.01%

AER/Tax-free (Fixed)

Find out more4.02%

AER/Tax-free (Fixed)

Find out more3.97%

AER/Tax-free (Fixed)

Find out more3.91%

AER/Tax-free (Fixed)

Find out moreAER stands for Annual Equivalent Rate and illustrates what the interest rate would be if paid and compounded each year

Here are some of the key things you should know before deciding if an ISA will work for you.

What is a cash ISA?

A cash ISA is an individual savings account which works like a standard deposit account, but with one big difference – you won’t pay income tax on the interest you earn. Each tax year, you’ll get an ISA allowance that lets you save a certain amount of money tax free. Keep in mind the tax rules can change, and might depend on your personal circumstances.

How do cash ISAs work?

You get an ISA allowance of £20,000 per year to deposit into your ISA, and the interest paid will be free from income tax as long as you don’t deposit more than the allowance. It’s quick and easy to open a Hodge account online, and once open, you’ll have 14 days to fund your account. You also have 14 days to close the account if you change your mind.

How does a fixed rate work?

A ‘fixed rate’ is a guaranteed interest rate for a set length of time. During that time, you won’t be able to access your money unless you pay an early access fee. A cash ISA is great for those with long term saving goals.

Find out more about our Cash ISA savings accounts.

Your nominated bank account is the account you register with us when you open your savings account, and is the one you’ll use to send money into your new Hodge account.

To help keep your money safe and protect against fraud, we’ll only accept deposits from this account, and we’ll always transfer money back to it too – whether that’s interest payments, withdrawals, or maturity. If your nominated bank account changes because you switch banks, let us know as soon as possible.

We’ve made it as simple as possible for you to set up online banking. When you apply for your ISA, you’ll automatically register for an online account at the same time. You’ll then use those details to manage your account in future.

Tax-free savings: Cash ISA accounts help your money grow long term. The interest you’ll earn is free of tax which means you can make the most of your hard-earned cash.

You know how much you’ll earn: With a fixed rate cash ISA, you’ll always know where you stand. You can be confident your savings are growing and know exactly how much interest your money is earning and the total sum you’ll get at the end of the fixed term.

FSCS protection: By choosing our fixed-rate ISA account you’ll have peace of mind that your cash will be protected up to £120,000 by the Financial Services Compensation Scheme. More information can be found here.

The ISA subscription limit is £20,000 for anyone eligible to invest. This can be saved in one ISA account, or across different Cash ISAs and Stocks and Shares ISAs, with different providers. You can only have one Cash ISA with Hodge, and we don’t offer other types of ISAs.

If you’re a UK resident aged 18 and over, and have some cash to save, then yes, you can apply for a Hodge personal cash ISA. There is a minimum deposit requirement of £1,000, so this might be the right account if you’re saving for a larger event or one off payment purchase, like a holiday or wedding.

No, you cannot transfer your existing cash ISA into a Hodge account.

Can you really save a house deposit on the UK’s average salary?

We're cutting through the noise and answering the question honestly - is the UK's average salary really enough if you're saving for a house deposit.

If you’re unsure how the ISA changes might affect your savings, here’s a simple three step guide to help you understand what’s changing and what’s staying the same.

New FSCS Limit and what it means to you

The Financial Services Compensation Scheme (FSCS) deposit protection limit will increase from 1 December 2025.

Why gifting money at Christmas is a thoughtful alternative in 2025

Find out why gift giving traditions are quietly shifting and gifting money at Christmas is becoming a thoughtful and genuinely useful, alternative.

Welcome to our 12 films of Christmas competition. Check back each day for a new film poster. Enter your guess on the page for a chance to win a £150 gift card.

Falling in love or falling for fraud? How to spot the signs of a romance scam

With romance fraud on the rise, we look at why even the savviest among us can be caught out.

Market confidence returns as development finance gains momentum

The UK’s unexpected expenses, revealed

Wondering how to deal with unexpected expenses? You’re not alone! Find out more about Brits’ emergency spending – and how to get prepared for life’s surprises.

Backing over 80 local pubs across Wales: Hodge supports Brew Propco Ltd with major investment

Read about our commercial investment loan helped Brew Propco Ltd buy a portfolio of 83 long leasehold pubs across South and West Wales.

How to make the most of your savings without locking them away

Save smarter without fixed terms. Explore the benefits of easy access savings accounts and keep your money working while staying in control.

Five hidden costs of getting a mortgage (and how to avoid them)

If you're a first time buyer, some costs can come as quite a shock. Here's our breakdown of 5 hidden mortgage costs you might not expect and what you can do to avoid getting caught out.

Is online banking safe? Ten tips to help keep your money secure

We want you to feel protected from fraud and scams, so we've listed 10 simple tips which can help you stay safe when banking online.

How much is the Personal Savings Allowance in the UK?

Most people can earn some interest on their savings without paying tax – thanks to the Personal Savings Allowance (PSA). Find out how much you can earn tax-free in our blog.

Why an Easy Access savings account could help your savings sizzle this summer

Whatever your plans this summer, topping up savings and not just your tan, could be a easier than you think.

Hodge Reduces Affordability Stress Rate to Support More Customers onto the Property Ladder

Understanding ‘Money Dysmorphia’ and if you have it

Let's take a deeper look at what Money Dysmorphia is, the potential impact and what to do if you think you have it.

Easy Access vs. ISAs: Making the most of your inheritance

If you have a lump sum of money and you're not sure whether to invest or save, we look at some options to keep your money safe, secure and growing.

Why Fixed Rate Bonds could be perfect for short-term savers

Explore how Fixed Rate Bonds work for short-term savers, what to consider before opening one, how they compare to other types of savings accounts.

Five expert tips to help first-time buyers onto the property ladder

The missing link in the property development supply chain

Gareth Davies, Real Estate Finance, shares how we're providing regional developers with more than just the financial tools to succeed in today’s challenging market.

Everything you need to know about bond maturity dates

What does a maturity date really mean for your savings and how do different maturity dates impact returns? Let’s take a look.

Easy Access savings accounts – your flexible way to save

We want your savings journey with us to be as effortless as possible. That’s why our Easy Access savings account has no strings attached.

Should I save money or overpay my mortgage?

Are you thinking about making a mortgage overpayment or wondering if it's a better plan to build up savings? We explore some the pros and cons to help you make a more informed choice.

Why choose an easy access savings account?

Looking for a savings account that gives you flexible access to your cash? An easy access savings account could be what your searching for.

Hodge Expands Mortgage Criteria to Support Foreign Nationals

How to change your money mindset

Find out the role your money mindset can play in your finances and life and the steps to making it a healthy one.

What is the cash ISA allowance?

A quick guide to saving money, the tax perks and transfers of cash ISAs.

What is cash stuffing and can it help me save quickly?

It's a modern twist on the old ‘envelope method’, but is it a game changer for savers or a riskier way to manage your money?

5 New Year’s resolutions to help you save in 2025

Find tips on how to create a monthly budget, some simple savings challenges and ways to stick to your financial goals.

Christmas on a budget: how to save money this Christmas

How to create a budget, shop smarter and cut back on unnecessary expenses at Christmas.

Hodge reintroduces its 5-year fixed rate Holiday Let products

We've reinstated our 5 year fixed rate products, added a new 2 year fixed rate product and reduced the rate on its current 2 year fixed rate product by 95 basis points.

Ben McConnachie, Hodge fraud expert, outlines 'the 12 scams of Christmas' and tips to protect yourself over the festive season.

Online fraud: top tips from our experts

Our Risk experts share their top tips for staying safe from online scammers.

Should I invest in a fixed rate bond?

There's lots of saving options out there - so let’s take you through how fixed rate bonds work and if they could be the right option for your money.

This guide covers everything you need to know about stamp duty, its exceptions, and steps to claim back what you may be eligible for.

Starting early when saving for Christmas can take the pressure off the big day. Here's some ways you can be an early saver for Christmas this year and every year.

Hodge enhances 50+ and RIO criteria to support more borrowers aged over 50 with complex incomes

Hodge provides £1.49m development finance facility to support property developer client

The property development and investment markets – how is 2024 shaping up?

Hodge makes major enhancements to its Professional Mortgage criteria

Commercial Lending December blog – Reflections on 2023 and thoughts for 2024

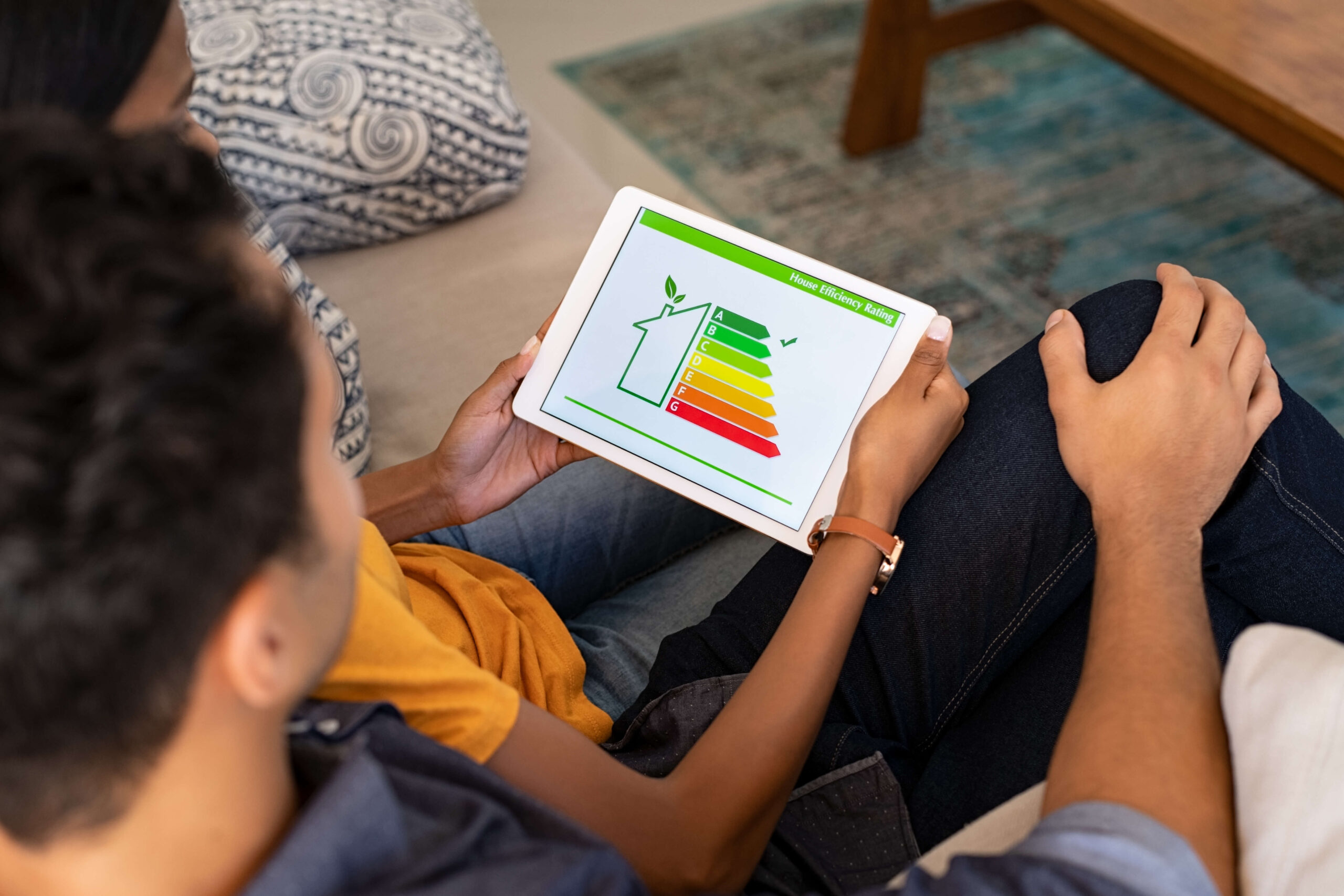

Navigating sustainable property development: key insights and changes

We’re proud to announce we’ve joined forces with FIBA as its latest lender partner

Hodge funds development of thirteen new homes in Llangefni, Anglesey

Hodge funds redevelopment of Barnet terrace property with St Mark’s Properties

Hodge provides £2.2m development loan to Fairview Homes Property Ltd

Hodge funds development of six new build houses in coastal town of Weymouth

Hodge reduces rates on holiday let mortgage product alongside 50+ and RIO

Generation ‘Baby Zoomers’ as over 50s now more tech savvy post-lockdown

Hodge ramps up Portfolio Buy-to-Let offering with higher LTV and new variable rate product

Hodge funds development of 22 homes with regional housebuilder, Clayewater Homes

Hodge funds renovation of Bristol’s “The Red Lion” Public House plus 9 new apartments

Conversion of former care home into 9 apartments in central Bristol funded by Hodge

Hodge funds excellent residential re-purposing on the edge of Bristol city centre

Hodge Commercial Lending team outlines new structure and plans for 2021

Hodge expands market coverage with new Portfolio Buy To Let and Specialised Investment proposition

Hodge funds development of 15 residential sea-view houses in coastal Ceredigion, South Wales