Browser Not Supported

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

If you’re wondering how to take control of your finances, you’re not alone. Our research shows four in five people don’t know how to manage their money in the current climate. Keeping track of your income vs your expenditure is an essential part of budgeting, but gone are the days where you need to go through your bank receipts manually – there’s an app for that!

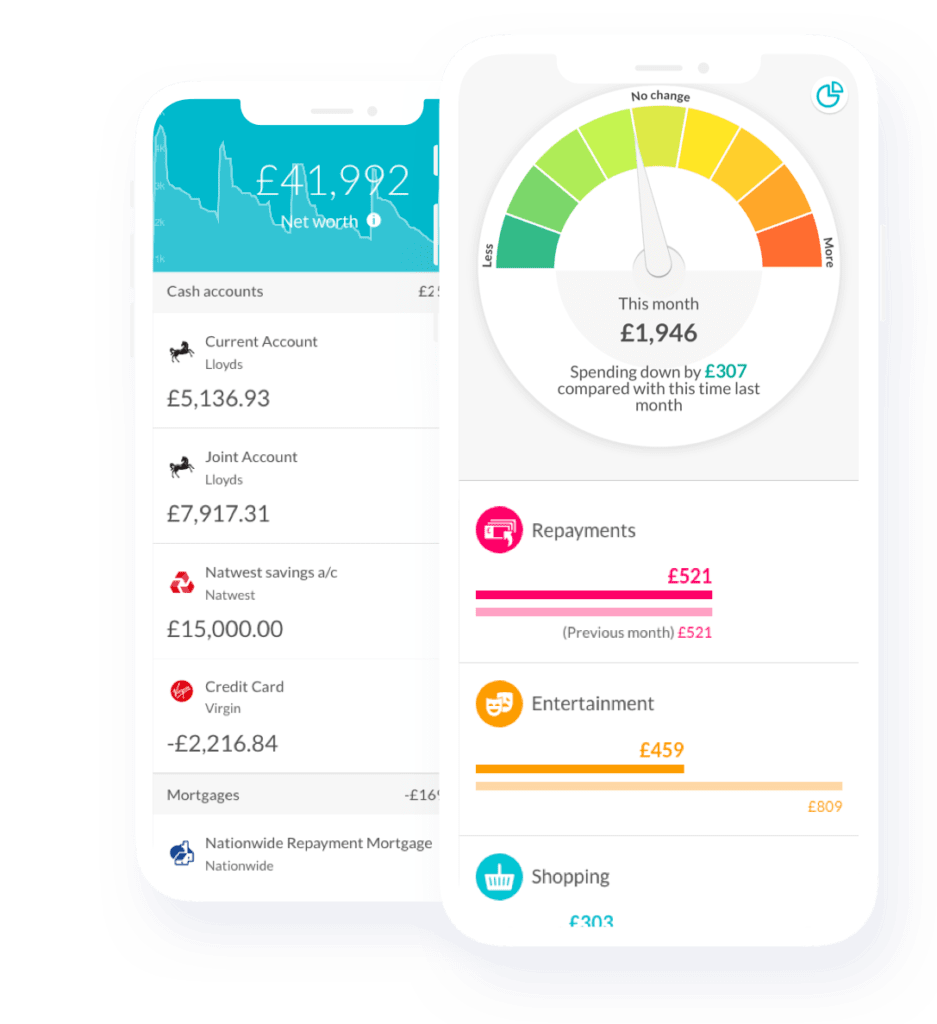

Open banking connects third party apps with banks, giving you more transparency on your spending. Simply download the app, connect your accounts and you’ll be able to see how much you’re spending on specific categories like shopping, groceries, gifts and travel each month.

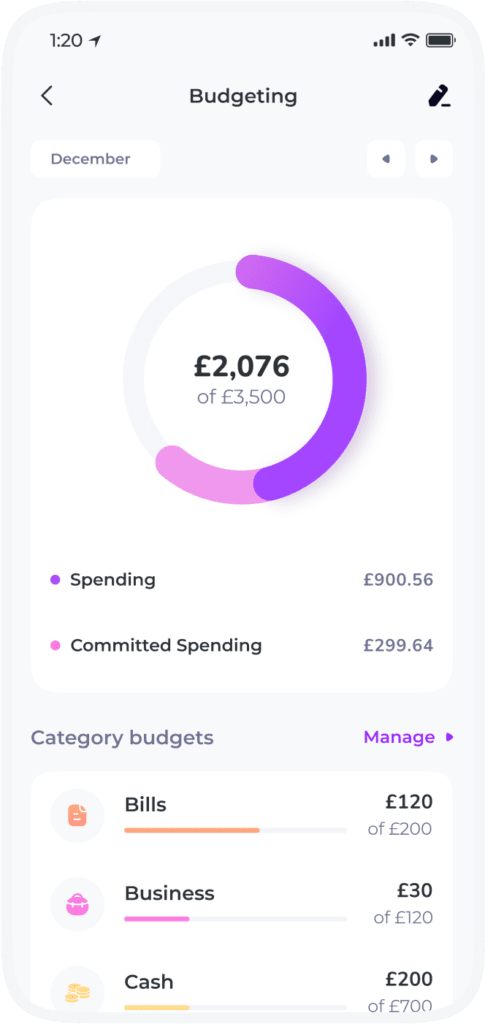

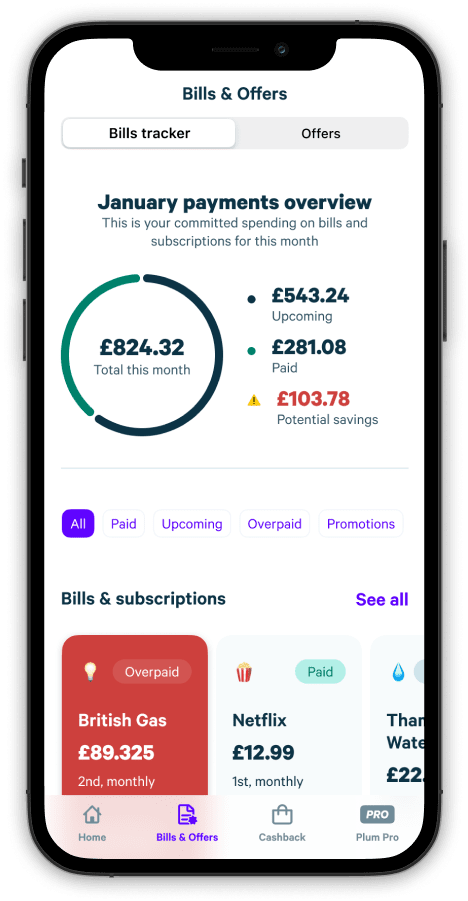

Those morning coffees really add up which is why tracking your expenditure can help in the long run. The apps have special features to help you set budgets, allocate funds and predict bills.

Open banking apps are perfectly safe, they use bank-level security and have been tested and approved for use. The apps are regulated and approved by the FCA or the European National Competent Authority, so make sure you only download apps from a verified store like Apple or Google Play. You can also check the Open Banking Registry for a list of approved and regulated apps before you share any personal information. Remember, budgeting apps shouldn’t store your bank passwords.

We round up three of the most popular apps on the market, so you can take the first step in managing your money and working to a budget.

Say hello to your ‘financial super app’

Features:

Starting tracking today and help your ‘money go further’ with Plum.

Features:

‘Know where you stand’ when it comes to your finances

Features:

Once you've found the right app for your needs, you might want to check out our blog on 10 things to consider when saving to help your money go further.