Browser Not Supported

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

Another stark rise is the number of people expected to still be paying off a mortgage well into retirement age. At the tail end of 2022 unbiased reported one in eight retirees were still paying off their mortgage. Six months later the Financial Times reported this as one in six.

To further support the growing number of later life customers we’ve reviewed our lending criteria for our 50+ and RIO mortgages and enhanced our criteria for pension drawdown.

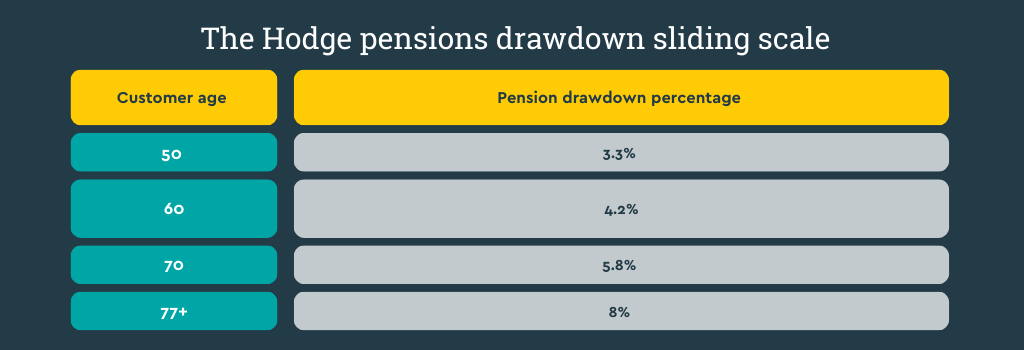

We're pleased to confirm that we’ve increased the percentage of drawdown pension we can accept to help more of your customers lending into retirement. Previous policy saw us accept 3% of pension drawdown on a blanket basis for all customers. Our new, enhanced policy allows us to accept drawdown pension income on a sliding scale from 3.3% up to 8% based on the age your customer intends to start drawing down as detailed on page 5 of the Hodge mortgage criteria and affordability guide.

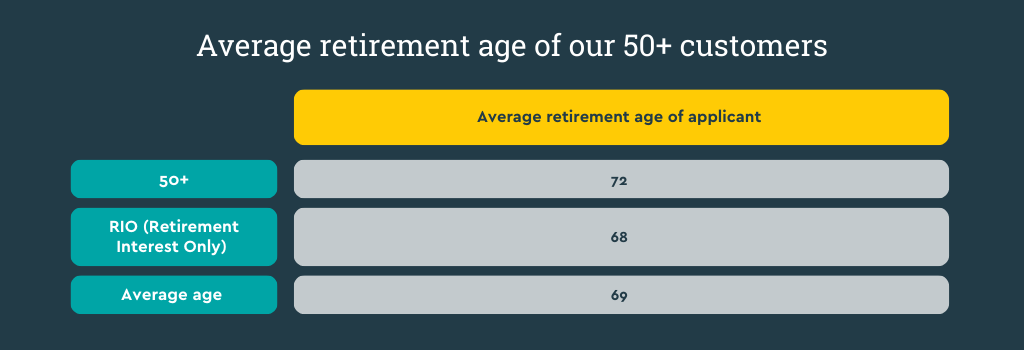

The average retirement age of our 50+ customers is 69 which would see us use 5.6% of their pension fund for affordability with customers above the age of 77 being able to utilise up to 8%.

The sliding scale has a gradual increase moving up a percentage point each one to two years. Ages 50, 60, 70 and 77+ are presented below only, you can find the full scale here.

Customer needs are becoming more complex, their circumstances are more composite. It’s never been more important to look at our 50+ and RIO customers on a case-by-case basis, working together to maximise affordability and lending potential when it’s the right decision for the customer.

At Hodge we pride ourselves on our human approach, expert underwriters making decisions on case-by-case basis. This enhanced approach is a continuation of how we serve clients, enabling our underwriting decisions to be even further tailored to customer needs based on their intended retirement age.

We’ve been evolving our specialist products to support the growing number of later life lenders for almost 60 years. We continue to reframe, challenge and adjust to ensure our underwriting outcomes are specific to meet the customer’s circumstances.

We’re experts in specialist lending and complex income. We’ll work with you so you can help your clients achieve their goals and manage their financial futures.

Emma Graham, Sales Director at Hodge comments “As your customers’ needs change as they look to lend into retirement this enhanced approach is an example of how we’ve used our underwriting expertise to challenge current policy. It has arguably never been more important to look at customers on a case-by-case basis and as a specialist lender this enhancement to policy allows our underwriters to tailor affordability based on intended retirement dates”.

If you’re looking for more information about our sliding scale for pension drawdown, speak to one of our BDMs today.