Browser Not Supported

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

At Hodge, we’re constantly evolving and ready to adjust and move with the needs of our customers. Here, business development director for mortgages Emma Graham, talks us through some of the changes we’ve made to support brokers and their customers. Reflecting on our products and using our intermediary partners’ feedback to make changes to further support our customers in the moments that matter.

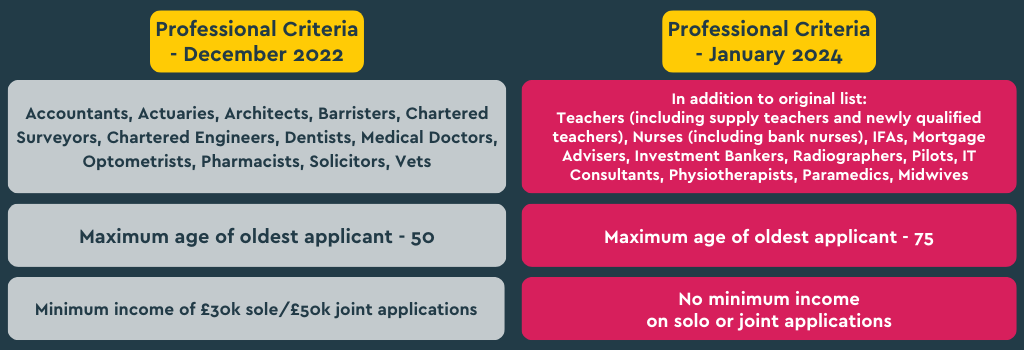

To talk you through our latest enhancements, we need to take a trip down memory lane and back to December 2022 when we introduced our Professional Mortgage to the market. A fitting addition to our specialist range of mortgages.

Hodge has been around since the 1960s, 1965 to be exact and even then we were making changes to the mortgage world with the introduction of Equity Release.

So, back to today, we’ve had our professional mortgage on the market for just over a year now. We’ve taken feedback from brokers who work with us, along with our own data, to help shape and adapt the Professional Mortgage.

When it launched, the Professional Mortgage was available to accountants, barristers, dentists, doctors, and vets to name a few. But based on the feedback we were getting from our intermediary partners, we saw the opportunity to grow that list. We’ve broadened our list of eligible occupations accordingly, making the product far more inclusive, helping you to help more of your customers.

Over the past year we’ve learned more about the professional customer and having originally launched with a maximum applicant age of 50, we now know this type of mortgage can be just as beneficial for those heading towards traditional retirement as those just starting out. So, we’ve enhanced our criteria and will accept income up to age 75 or planned retirement. With the aim of supporting customers throughout their career and into retirement, making complex things such as a mortgage seem simple.

The rising cost of living is making life harder for everybody, we’re trying to lighten the load where we can, allowing professionals at the start of their journey a chance to climb the career ladder while hopping on the property ladder. Life is more complex these days and so are our customers, we’ll be as flexible as possible to help them.

Being flexible and supporting customers doesn’t just apply to professionals, it applies to everyone. Over the past three years we’ve seen an increase in cases with debt consolidation as the loan purpose. With the cost-of-living crisis and rising interest rates making unsecured debt less palatable, it’s leading customers to consolidate onto lower rates where possible. We’re always looking across our whole product suite for areas where we can help our customers. Consolidating debt and the need for larger loan capabilities were areas we found needed attention.

Across our 50+, RIO and Professional products our criteria was capped for debt consolidation cases at 60% LTV for interest only and repayment. We now will accept up to 75% LTV on interest only and 85% LTV for repayment. We’ve recognised our customers need help and we’re adjusting our criteria to help them repay any debts.

Our intermediary partners are just that, partners and we speak to them regularly and take feedback but also listen to what they’re seeing out on the market and where they need assistance from us. After speaking with them over the past 12 months we recognised the need for a larger loan set across our 50+, RIO and Professional products.

So, we got to it. Our previous banding was £1.5m up to 75% LTV and £750k up to 90% LTV.

We’ve enhanced our set to the following, and introducing up to 85% LTV:

Customers needs are diverse and complex, we’re ready to move with them and support them on their forever journey. We see these latest enhancements to our later life and professional product portfolio as further demonstration of our commitment to continually improving the markets we operate in as a means to supporting our intermediary partners and their customers in the moments that matter.

You can find more information on our Professional Mortgage products, here.

Find a BDM near you, they’re happy to help and answer any questions.