Browser Not Supported

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

In 2018, with the FCA wanting to make affordable borrowing more widely available to the mature sector, Retirement Interest Only mortgages hit the later life market. A new breed of lending was introduced, the RIO. And on June 8th 2018 Hodge were first to market.

Designed specifically for mature borrowers, as the first interest-only mortgage with no end date, the RIO offers greater flexibility and stability than what was previously available. It was initially met with some trepidation from mortgage brokers and advisers. Five years on, is this still the case? Or has RIO taken off?

As the number of borrowers looking at mortgage options beyond retirement age increases, we look at the rise of the RIO mortgage and why it continues to hold its own in the later life market.

Pre-RIO, borrowers with a steady income and looking to remortgage when they hit retirement faced a hard barrier. Options were limited and costly with equity release often being the ‘go to’ or the only option.

Times have changed and the RIO is now the fourth most popular loan catering to over 55s across the UK. Currently accounting for 19% of the overall Hodge book, it remains a welcome option for the older borrower. In 2022 we saw a 58% increase in the value of the Hodge RIO book compared to 2019, RIOs first full year in the market. And its trajectory is on course to for further growth.

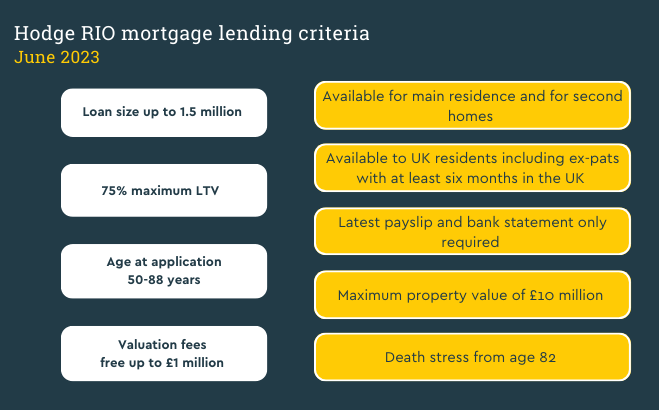

Over its five years in the market, RIO has evolved, further adapting to fit the needs of the customer. We’ve expanded our lending criteria at Hodge across many parameters over the last few years to widen RIOs appeal, meeting the needs of a larger audience and lowering the age at application to 50.

The original loan size available in 2018 was between £20k and £500k, today we offer RIO mortgages up to £1.5million. The maximum LTV grew from 60% in 2018 to 75% today. The maximum property value considered has also increased, and free valuation fees have been added to offer more flexibility for the borrower.

“Socio-economic pressures and changing demographics are contributing to later life lending being an ever-growing area of significance in the mortgage industry. But there are many reasons to borrow into later life, and it isn’t always down to affordability and financial need. Later life lending is also for the financially savvy, those who want to pass down their wealth, now or in the future, and keep equity in their homes. A RIO can meet the needs of these customers and their whole family.” Lee Weston, head of business development at Hodge.

Created for borrowers aged over 50, and available up to age of 88 at application, there is certainly no ‘one size fits all’ when it comes to a RIO customer. From retirement planners to those looking to unlock capital in their home, here are some of the key reasons customers are choosing RIOs.

Customers planning for retirement

The UK population is ageing. Today there are almost 11 million people over the age of 65, many of whom will be making plans to ensure they can fund their lifestyle choices once they finish their working lives. They also want to protect the equity in their home and leave inheritance to loved ones. At Hodge we don’t believe balancing these needs should feel like making Sophie’s choice.

For those approaching retirement, a RIO offers the option to remortgage to interest only, which could be more affordable for those on a pension income while still keeping any value left in the house once the property is sold and the mortgage repaid.

The most popular reason for our customers choosing a RIO over the past four years has been to reduce monthly outgoings by having an interest only mortgage. Proving the value of RIO as a tremendously useful product for those hitting retirement with sometimes less disposable income, but able to afford monthly interest payments.

Customers looking to unlock value in their home

Family gifting, buying another property and home improvement are key reasons we see customers choosing a RIO mortgage. When RIO launched as a product in 2018, these three reasons accounted for 49% of why Hodge RIO mortgages where taken. A year later, in 2019 this climbed to 58% and still is that high today.

A RIO can make more financial sense for some customers looking to unlock value in their home, as it is a requirement that the interest is paid in full each month the amount they owe won’t grow. This structure can bring peace of mind for some customers. This structure also brings comfort to lenders and allows Hodge to offer up to 75% LTV at age 50 which means they can have access to a much larger lump sum at a younger age.

Customers with existing interest only mortgage

For many customers with an interest only mortgage, they have become a ‘mortgage prisoner’. They don’t have the money to repay the capital owed and they no longer want to sell up or downsize. Many struggle to remortgage to further interest only deals with their existing lender as they are penalised due to their age. A RIO gives them a way to do this into much later life. They maintain smaller monthly repayments but keep the home they love with less drain on their income. As a RIO isn’t a fixed term, it also takes the worry away about paying it back after a certain period.

Customers planning an inheritance

A RIO isn’t just about releasing money tied up in their homes, homeowners also want to protect the equity they have so they can plan an inheritance. As customers with a RIO mortgage are paying off interest on the loan each month, they’re more likely to have equity left in their home to leave to loved ones.

Our recent Hodge research found 66% of Brits are concerned about managing their finances and 61-70 year olds were most concerned about the rising costs of energy bills. But the rise in the cost of living is just one of the reasons the specialist lending market is growing and is expected to continue to do so over the coming decade.

It’s important to remember that those over 50 still have borrowing needs. Whether it’s funding lifestyle changes, improving their existing home, gifting money to family or buying a second home. At Hodge, we’re seeing a demand in the mature borrowing market for these reasons and more. Combined with the maturing of existing interest-only mortgages and people working beyond ‘normal’ retirement age. We can all expect to see a further rise in flexible and stable financial products such as RIO.

"RIO may be niche, but it is pivotal for providing a solution for the growing number of borrowers, who without it, would not have had their needs met. With Consumer Duty within sniffing distance, it’s crucial that brokers have a holistic view of all the products available to meet the needs of mature borrowers.

“It has never been more important for advisors to understand and consider all mortgage options so they can find the solution for customer increasingly complex needs. At Hodge, we’re experts in specialist lending and we want to support and educate brokers in understanding the markets we serve and expanding their knowledge.

Whatever brokers need, we’re ready to help. Whether that’s speaking directly to a BDM, joining our webinars or visiting our Knowledge Hub."

Emma Graham, business development director at Hodge

We may have been one of the first to launch the RIO just five years ago, but we’ve been supporting later life customers with their financial future since 1965.

We use our expertise to create mainstream mortgages for over 50s with a term into later life. Why? Because we did our research and learned that todays over 50s want more choice, more options and different ways to borrow. We're experts and we know we can help serve the underserved with this expertise.

We work for the better of the borrower, but we're also there for the broker. Being 100% intermediary led, we take time to really help advisers and brokers get to know us, our products and how we can help. We attract both mainstream and later life specialists with our offering.

If you’re looking for a specialist lender, why not speak to the original? Contact one of our BDMs today.