Browser Not Supported

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

We no longer support Internet Explorer 11 as a browser.

Please download a more secure modern browser below.

The mortgage market moves quickly in 2024, which is why staying flexible and innovative is vital for lenders. At Hodge, we’re constantly evolving, staying ahead of the curve so we can tailor our products to meet the diverse needs of our customers.

As we pass by the one-year anniversary of our Professional Mortgage, it’s exciting to see how much it’s grown in such a short time, enhancing to ensure it’s positioned to provide you and your clients with the most effective solutions.

And, please excuse the birthday puns – we couldn’t resist celebrating the milestones of our journey with a bit of fun!

Happy first birthday to our Professional Mortgage

A little over a year ago, we welcomed the Professional Mortgage into our specialist range, designed with the needs of professionals in mind. This addition was inspired by our desire to offer more flexible and comprehensive mortgage solutions. Since then, we’ve continued to adapt the criteria based on valuable feedback from you, our brokers.

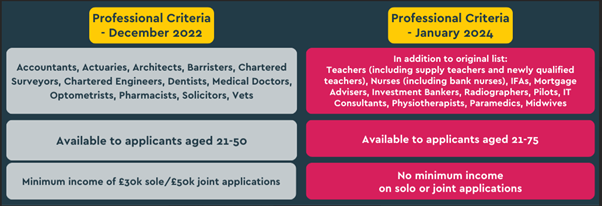

Guest list extended to mortgage brokers and more

One of the big changes we’ve made is broadening the amount of eligible occupations, including mortgage brokers and IFAs, as well as teachers, nurses, and IT consultants, to name a few. This development is a testament to our dedication to inclusivity, enabling you to assist a broader spectrum of professionals.

Expanding the age range

We've also revisited our age criteria based on a deeper understanding of the professional customer's journey. We originally capped a maximum age of 50 on application, however we now consider income up to age 80 or planned retirement, acknowledging the diverse career and retirement trajectories of today's professionals. This adjustment is part of our broader aim to simplify complex processes like mortgages, making them accessible and manageable across different life stages.

Adjusting the age criteria will support professionals at every career stage, from early strides to planning for retirement.

Interested (only) in a little cake?

This rise in the cost of living has undeniably impacted people across the board, including professionals. Our flexible approach caters to the complexities of modern life and diverse income, ensuring our customers can progress on both their career and property journeys.

Our interest only proposition could be the perfect solution to a variety of clients’ needs lending up to 75% LTV and accepting multiple repayment strategies.

“At Hodge, our goal has always been to respond proactively to market trends, ensuring we can continue to support our brokers and their clients when it counts the most. Life is more complex these days and so are our customers, we’ll be as flexible as possible to help them.

These enhancements, so early on in the Hodge Professional Mortgage journey, are a reflection of our efforts in response to recent insights, fine-tuning our services to meet your needs. And we're excited to support professionals at every turn of their journey.”

The Hodge Professional Mortgage journey

And the celebration doesn’t end there

Flexibility and support extend beyond professionals to all our customers. In light of the cost-of-living crisis and increasing interest rates, we've seen a rise in debt consolidation cases. To address this, we've adjusted our criteria across our product suite, including the 50+, Retirement Interest Only (RIO), and Professional mortgages, to accommodate higher Loan to Value (LTV) ratios for debt consolidation and larger loan needs.

So, let’s keep the party going

Our intermediary partners are just that, partners and we speak to them regularly and take feedback but also listen to what they’re seeing out on the market and where they need assistance from us. After speaking with them over the past 12 months we recognised the need for a larger loan set across our 50+, RIO and Professional products.

We’ve enhanced our set to the following:

Cake or no cake, we’re always here to help

Customers’ needs are diverse and complex, we’re ready to move with them and support them on their forever journey. We see these latest enhancements to our later life and professional product portfolio as further demonstration of our commitment to continually improving the markets we operate in as a means to supporting our intermediary partners and their customers in the moments that matter.

You can find more information on our Professional Mortgage products, here.

Find a BDM near you, they’re happy to help and answer any questions.