At Hodge we’re always working on ways to evolve and better support customers. Income isn’t a straight line for most these days. We’ve enhanced our criteria to help customers unlock more in the way of affordability.

What exactly has changed?

- We’ll now accept up to 100% of non-contractual income streams including bonus, commission, and overtime

- Effective immediately, we’ll accept one year’s trading accounts OR the latest year’s where your customers have been trading two years or more, regardless of their LTV and can also consider retained profit

- There are no minimum income requirements for experienced contractors and affordability for will be assessed on 48 week’s pay (up from 46) for day rate contractors

- Accepted gaps between contracts have been increased to 3 months (previously 6 weeks)

- Day one fixed term and day rate contractors are now acceptable

Call your local BDM for more information on our enhancements

Emma Graham, our business development director, said this of our latest enhancements:

“Hodge has been steadily developing its range of lending products over a number of years to help give more professionals with less conventional earning patterns enhanced borrowing power. This is not always possible on the high street.

“We have been assessing cases where diverse and variable income streams are involved for some time and have built a strong reputation as a market leader in specialist lending.”

Want to know more? Speak to a BDM

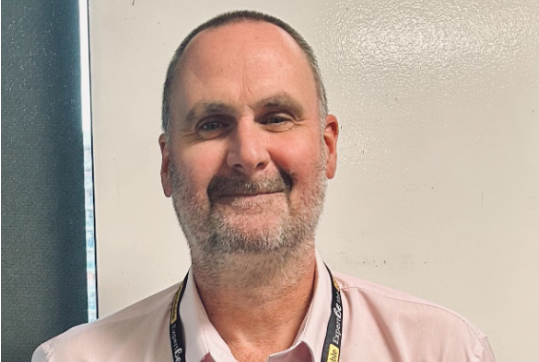

Head of mortgage origination, Rob Ford added his views from an underwriting viewpoint:

“Underpinning this are our highly experienced underwriters who manually underwrite applications, with each case being assessed on its own merits. What we know from all of our work to date is, in the current economic climate, many more people are not only earning their living in a variety of different ways, but borrowing well into retirement too.

“Taking the step to support borrowers with diverse income streams who are aged 50 and above, and broadening the range of borrowing options available to them into later life is the logical next step for Hodge.”

To find out more about our mortgage products, please visit our intermediaries website.